Dynamics of Opinions Regarding Banking

especiales

The implementation of the so-called banking process in the country has spawned various opinions among internet users and the Cuban population in general over the past two years, a clear reflection of its complexity.

It was evident from the outset that banking, or rather, the massive implementation of payment methods via electronic gateways, would generate confusion, uncertainty, and even rejection.

Certainly, at the time of the implementation of Central Bank Resolution 111 on August 2, 2023, which is considered the launch date of this policy, there was already accumulated experience with the existence of the very popular Transfermovil and its counterpart Enzona, many people were paying for public services such as electricity, water, telephone, or taxes through these gateways. Even further back, bank cards were already being used, as an original expression of digitalization in the sector. In short, that August 2nd was not a starting point.

But logically, the big news was the widespread non-use of cash to purchase anything, whether products or services, with particular difficulty and resistance in retail, not just in the private sector. This circumstance generated all kinds of rejection, challenging the centuries-old custom of paying with cash or bills in hand.

Another problem, which ultimately demonstrated its impact on public opinion, was the circumstances of the Cuban economy, both in August 2023 and now, negatively marked by a persistent crisis, especially the problems with the National Electricity System, a vital service for the proper functioning of electronic payments.

In other words, for some, it was an excellent idea, a very beneficial project, but within the context of a "terrible" socioeconomic situation.

On the other hand, the communications policy itself, faced with the novelty of explaining and convincing people of the virtues of this policy, had to struggle not only with timely reporting on the procedures and ways to use the gateways, but also with generating a new payment culture, a colossal task that usually requires a lot of time, effort, and resources.

With so much uncertainty surrounding the course of the economy, trying to convince people that the country had more than enough infrastructure to deploy electronic payments proved to be another huge subjective obstacle to popularizing this process.

This preamble briefly serves to understand the opinions generated among the Cuban population by the policy of widespread use of electronic payment gateways or the banking process.

It goes without saying that opinions vary depending on the location of the commentator, with marked differences between urbanized areas, particularly Havana, and more rural areas, where, in addition to the distance from territories where bank branches operate, there are also the logical difficulties in connecting.

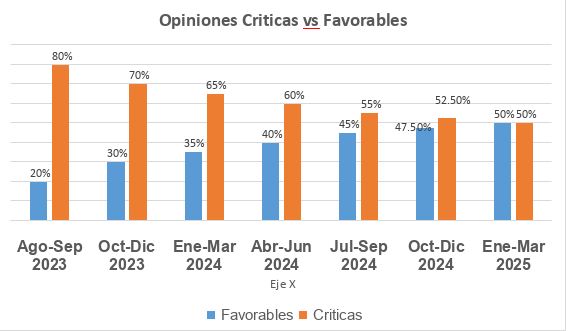

Using an AI tool, an approximation was made of how the opinions of internet users published on Cubadebate evolved, ranging from critical to favorable; it’s not the only media outlet that addressed the issue, but it’s undoubtedly representative of the bulk of publications on the topic and how the population sees it.

In this regard, the following graph shows the data collected, divided by quarters from August 2023 to March 2025.

t a single glance, it’s relevant that, while at the initially, unfavorable opinions were significantly in the majority, which evolved into a scenario in which half of the opinion-makers support the banking process. This trend is significant and demonstrates that the benefits, such as the security and convenience of using the gateways, as well as the communication policy itself, have had a positive impact.

Summary of Opinions

Also using the same tool, it was possible to summarize the opinions expressed, both those who published their views on Cubadebate, and those published on the institutional pages of the Bank itself, the Ministry of Finance and Prices, and the Ministry of Domestic Trade, leading entities in this process.

Of course, the most persistent criticisms relate to the complaint of cash shortage, precisely a problem that, as of August 2023, served as a trigger, a circumstantial reason, to expand cashless payment methods.

At that time, a commendable effort was made in training and education, reaching thousands of people not only through traditional media but also involving Computing Clubs and other community organizations, particularly targeting senior citizens, who were seen from the outset as the most reluctant or those with cognitive difficulties in embracing these innovative payment methods.

Resolution 111 itself, which limits the amount of cash that account holders can withdraw, also generated and continues to generate questions, as well as specific difficulties in withdrawing cash, either due to insufficient supplies or the occasional deterioration of ATMs, or due to the operation of bank branches.

The debate, the concern about the ATM issue, revealed another problem for those in charge of promoting this policy, it seems they don't understand that the more electronic payment gateways are used, the less need there is for ATMs.

Another issue revealed by the systematic study of opinions relates to those arising from the progress made in implementing the process. For example, the increased level of demand that these forms of payment be respected by the various economic actors has been very illustrative.

For example, it has gradually been accepted that one of the virtues of the process is that it allows for transparency in economic flows and the payment of tax obligations, particularly those of non-state management systems (NSMS), which are viewed by some segments of the population as tax evaders.

Like any other process that bursts into everyday life by encouraging people to change traditional ways of acting, the widespread use of electronic gateways in Cuba has also triggered and continues to spur controversy, rejection, and acceptance.

The good news is that, as already mentioned, the evolution of opinion is progressing, perhaps not as quickly as needed, varying according to population sectors or economic actors, but it’s now undoubtedly widely understood by the population.

The challenge is certainly still huge, as stated, because the process must deal with problems that are beyond its reach, such as those affecting the national electricity system, or the tax evasion practices of various economic actors. This issue, strictly speaking, goes beyond the issue of banking access, as hard efforts are also required to improve the tax literacy of the Cuban population.

One final consideration: the day critical opinions are not voiced, the day questions are not raised, it means something is wrong. The point is to always draw on the inexhaustible wisdom of the people and correct the mistakes made by those in each territory or municipality who must implement this policy; after all, it’s new to them as well.

The widespread use of digital payment methods equals progress, many believe, and we agree on that.

Translated by Amilkal Labañino / CubaSí Translation Staff

Add new comment